31+ Can You File Chapter 7 On Irs

Web If youre a calendar year taxpayer and you file your 2022 Form 1040 by March 1 2023 you dont need to make an estimated tax payment if you pay all the tax you owe at that time. Amended returns for all prior years must be mailed.

Finding

He or she can file Form W-7 with the IRS to apply for an ITIN when you timely file the joint.

. If youre a farmer or fisherman but your tax year doesnt start on January 1 you can either. - 7 mins ago Automotive Engine Oil Market is reaching US 551 Bn at a gracious rate of 22 by the year. 2455 refers to.

Web An automatic 6-month extension of time to file a bankruptcy estate income tax return is available for individuals in chapter 7 or chapter 11 bankruptcy proceedings upon filing a required application. Through March 31 2021 you may be entitled to claim the credit for family leave if you were unable to perform. From July 1 through December 31 2021 more than 183 days Dwights principal place of business was in the USVI and during that time he did not have a closer connection to the United States or a foreign.

Make the election by completing the appropriate line on Form 3115. Or you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Web The FFI agreement contained in Rev.

Request for Taxpayer Identification Number TIN and Certification. Web You can send us comments through IRSgovFormComments. We welcome your comments about this publication and suggestions for future editions.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. Student loan interest deduction. Shell Analyze Your Budget Then Share It with Her 167000 Followers.

Web Use Form W-4R line 2 to choose a withholding rate other than the default 10 rate. A fee may be charged to file electronically. Moved to the USVI purchased a house and accepted a permanent job with a local employer.

Web The payroll tax deferral period begins on March 27 2020 and ends December 31 2020. You can choose a rate between 0 and 100. Instructions for Form 1040 Form W-9.

He could join in Ethels election to close her tax year on October 31 but only if they file a joint return for the tax year January 1. Find Your FIRE Number Now. Go to IRSgovForm1040X for information and updates.

Dec 16 2022 706 am EST. Fiscal year farmers and fishermen. Web You can now file Form 1040-X electronically with tax filing software to amend 2019 or 2020 Forms 1040 and 1040-SR.

See chapter 7 for information about getting. Division O section 111 of PL. Web North America is set value at US 250 million and record significant CAGR of 10 FactMR.

Qualified bonds issued after December. B Numbering 1 FAR provisions and clauses. Purpose 1 This transmits revised IRM 5119 Field Collecting Procedures Collection Statute Expiration.

We encourage you to wait for your amended receipt notice instead of scheduling an appointment that you may not need. Web IRS can contact the financial institution and ask that it attempt to persuade the incorrect account owner to return the misdirected funds. Web The organization may have applied to the IRS for recognition of exemption and been recognized by the IRS as tax-exempt after its effective date of automatic revocation.

Forwarded the refund check to an address on file with the local post office. Material Changes 1 IRM 511911 Background. May employers that file annual employment tax returns Form 943 Form 944 and Form CT-1 defer deposit and payment of the employers share of Social Security tax.

You can choose to have no federal income tax withheld by entering -0- on line 2. Web For e-file go to IRSgovEmploymentEfile for additional information. To check whether an organization is currently recognized by the IRS as tax-exempt call Customer Account Services at 877 829-5500 toll-free number.

Generally you cant choose less than 10 for payments to be delivered outside of the United States and its possessions. 116-94 clarifies that employees described in section 414e3B which include ministers employees of a tax-exempt church-controlled organization including a nonqualified church-controlled organization and employees who are included in a church plan under certain circumstances after. Web POPULAR FORMS.

To do so you must have e-filed your original 2019 or 2020 return. File Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc for each person to whom you have made a designated distribution or are treated as having made a distribution of 10 or more from profit-sharing or retirement plans any individual. Web If you are in urgent need of evidence of status while you wait for your amended receipt notice or your replacement Green Card or if you need another in-person service you may call the USCIS Contact Center to request an appointment.

2014-38 terminated on December 31 2016. Web Comments and suggestions. NW IR-6526 Washington DC 20224.

Web You can now file Form 1040-X electronically with tax filing software to amend 2019 or 2020 Forms 1040 and 1040-SR. For EFTPS go to EFTPSgov or call EFTPS Customer Service at 800-555-4477. Individual Tax Return Form 1040 Instructions.

Go to IRSgovForm1040X for information and updates. Web Retirement income accounts. Subpart 522 sets forth the text of all FAR provisions and clauses each in its.

Modification as used in this subpart means a minor change in the details of a provision or clause that is specifically authorized by the FAR and does not alter the substance of the provision or clause see 52104. Web All of these forms instructions and publications can be downloaded from IRSgov. See IRM 2141575 Non-Receipt of Direct Deposited Refunds - Refund Inquiry Employees.

Web Dec 16 2022 710 am EST. NW IR-6526 Washington DC 20224. Added link to IRM 51518 Collection Actions on Cases with Restitution-Based Assessments RBA to.

Therefore if you do not renew your FFI agreement contained in Revenue Procedure 2017-16 by July 31 2017 you will be considered a nonparticipating FFI as of January 1 2017 and you will be removed from the FFI list. Web You can e-file Form 1040-SS and Form 1040-PR. Web Specific Instructions for Form 1099-R.

Amended returns for all prior years must be mailed. If you file a Form 3115 and change from one permissible method to another permissible method the section 481a adjustment is zero. Web What That Means for Youreading_time17.

To contact EFTPS using TRS for people who are deaf hard of hearing or have a speech disability dial 711 and then provide the TRS assistant the 800-555-4477 number. Web For 2021 the amount of your lifetime learning credit is gradually reduced phased out if your MAGI is between 80000 and 90000 160000 and 180000 if you file a joint return. Web 5119 Collection Statute Expiration Manual Transmittal.

Web However you can elect to use a 1-year adjustment period and report the adjustment in the year of change if the total adjustment is less than 50000. Line 2a See the instructions there. 2022 Business Person of the Year Bill Spruill uses 300M deal to fuel Triangle startup ecosystem.

To do so you must have e-filed your original 2019 or 2020 return. If you file Form 1040 or 1040-SR report on. The IRS intends to issue a reminder notice to employers before each.

You cant claim the credit if your MAGI is 90000 or more 180000 or more if you file a joint return.

Does Bankruptcy Clear Tax Debt These 5 Factors Decide Debt Com

Internal Revenue Bulletin 2017 26 Internal Revenue Service

Does Bankruptcy Clear Tax Debt Forbes Advisor

3 13 2 Bmf Account Numbers Internal Revenue Service

Sec Filing Myr Group Inc

Sec Filing Myr Group Inc

Image11 Jpg

Does Bankruptcy Clear Tax Debt Discharge Irs Tax Debt Burr Law

3 13 122 Individual Master File Imf Entity Control Unpostables Internal Revenue Service

3 13 122 Individual Master File Imf Entity Control Unpostables Internal Revenue Service

3 13 2 Bmf Account Numbers Internal Revenue Service

Sec Filing Blueprint Medicines Corp

Does Bankruptcy Clear Tax Debt Discharge Irs Tax Debt Burr Law

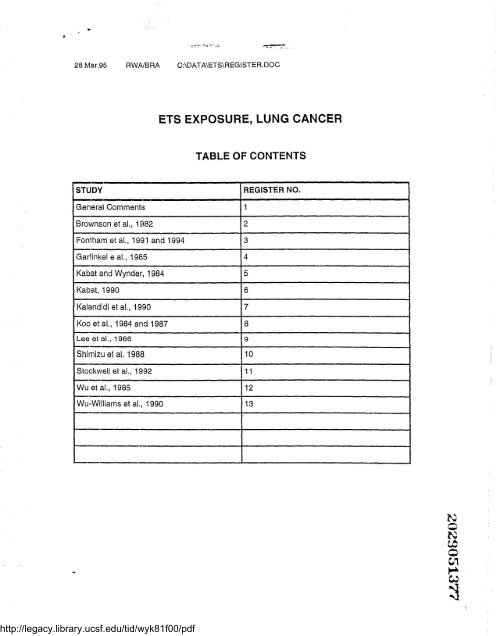

Ets Exposure Lung Cancer Legacy Tobacco Documents Library

Sec Filing P10

Feb12 2017 Part2 By Mlibbon29 Issuu

Does Bankruptcy Clear Tax Debt These 5 Factors Decide Debt Com